Residential Property Review – December 2022

Demand drops amid economic uncertainty

Activity is weakening across the sales market, according to the latest UK Residential Survey from the Royal Institute of Chartered Surveyors (RICS), which points to a challenging year ahead.

The headline net balance for new buyer enquiries was -38% in November, a seventh successive negative monthly reading. Similarly, new sales agreed fell by 12% between October and November, according to TwentyCI, settling at 17% below the 2017-2019 average for the month.

Worsening buyer sentiment is one of several negative indicators in a challenging macroeconomic climate, the survey shows. New instructions coming onto the sales market is still in negative territory, with the RICS survey reporting a net balance of -9% at the aggregate level.

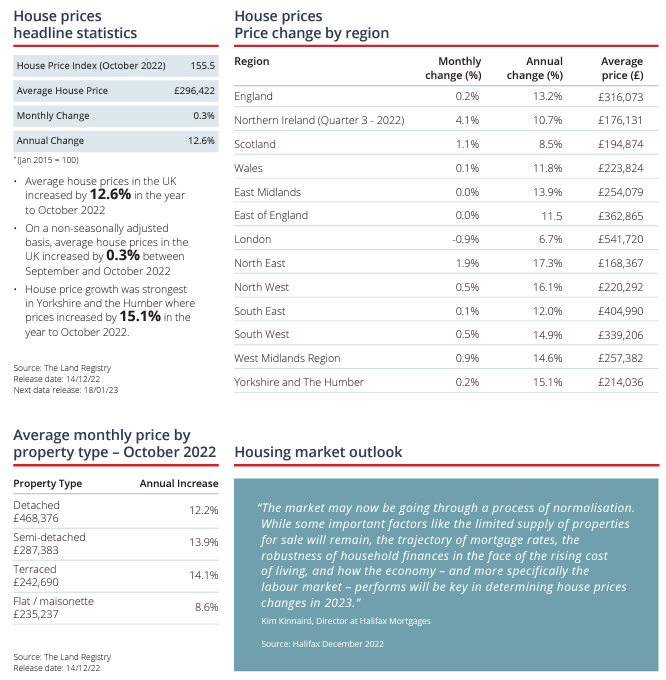

House prices are in decline too – a net balance of -25% of respondents have seen a house price fall at the national level, which rises to -61% for those who foresee a further drop in the coming year. Buyers are ‘sitting on the fence’, one respondent surmised.

Government falling short of affordable homes target

A government programme to build more affordable housing in England is a long way short of its target, a report by the Public Accounts Committee has revealed.

The report states that the government is likely to deliver 32,000 fewer homes than the aims of its 2016 and 2021 affordable homes building programmes. The Department for Levelling Up, Housing and Communities has already downgraded its forecast for the 2021 programme from 180,000 to 157,000 new homes.

The biggest shortfalls are in rural areas, where housing waiting lists stretch to a quarter of a million people, according to the Country Land and Business Association.

Chair of the Committee, Dame Meg Hillier MP, commented, “Many people in high-cost areas simply can’t afford to rent privately or buy their own home and there’s a desperate need for affordable, secure rented homes… The human cost of inaction is already affecting thousands of households.”

Mortgage support for borrowers set out

The Financial Conduct Authority (FCA) has published guidance aimed at helping people who are struggling to keep up with mortgage repayments following a meeting with Chancellor Jeremy Hunt and bank chief executives on 7 December.

The guidance outlines the flexibility lenders can show to support those who have missed monthly payments, with options including an extension to the mortgage term and reduced payments for a temporary period.

Mr Hunt urged lenders to show flexibility amid the cost-of-living difficulties that many are facing. He said, “We expect every lender to live up to their responsibilities and support any mortgage borrowers who are finding it tough right now.”

As a mortgage is secured against your home or property, it could be repossessed if you do not keep up mortgage repayments

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from, taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission.